Industry Brief: Mobilizing Private Capital to Close the Sustainable Infrastructure Gap in 2025

Vh

The Landscape

In 2025, global demand for infrastructure investment has never been clearer nor have the stakes been higher. We need to build resilient energy grids, reliable water systems, sustainable transport networks, and climate-adaptive water infrastructure. Yet despite the urgency, a persistent funding shortfall looms: estimates suggest a multi-trillion-dollar gapbetween what is needed for sustainable infrastructure and what is currently financed.

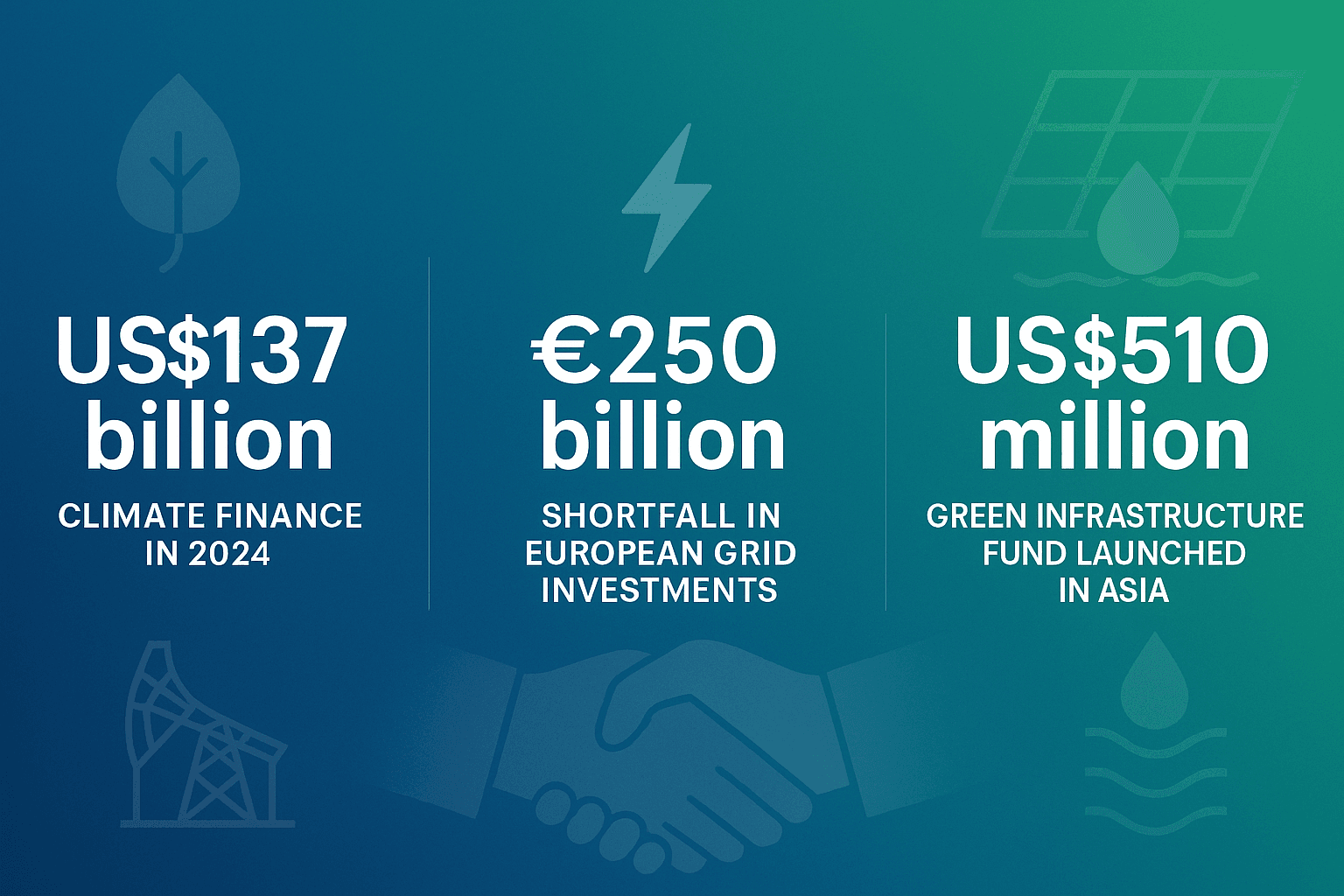

Simultaneously, climate finance has hit record levels. Multilateral development banks (MDBs) provided over US$137 billion in climate finance in 2024, a 10% increase over the prior year. But much of this funding goes toward mitigation; adaptation, water infrastructure, and resilient systems continue to struggle for sufficient support.

What’s Driving Change

Three key trends are shifting the dynamics:

Emergence of New Labels & Standards

The infrastructure industry is converging on standardized frameworks that help investors assess ESG risk, climate resilience, and sustainability at scale. For example, tools like the FAST-Infra Label (for sustainable infrastructure projects) are gaining traction, helping projects become more “investment grade” by improving transparency, comparability, and credibility.

Growth of Local Capital Pools

As external funding faces headwinds (higher interest rates, geopolitical risk, regulatory volatility), there’s increasing interest in mobilizing domestic institutional capital pension funds, sovereign wealth funds, insurance companies to invest in long-term infrastructure. In Africa alone, domestic institutions have trillions in assets that are under-deployed in local infrastructure. Reuters

Hybrid Finance Models & De-Risking Structures

With return expectations and risk aversion heightened, finance models that combine public & private capital (PPP, blended finance, guarantees, catalytic capital) are becoming essential. These help bridge risk gaps (e.g. for early-stage feasibility, environmental approval, political/regulatory risk), making marginal projects viable.

Implications for Infrastructure Advisory & Delivery

For firms operating in 2025, including those planning, financing, or building infrastructure, the above trends imply:

Preparation & transparency matter: Projects must meet the growing expectations of investors regarding climate resilience, ESG reporting, environmental approval, and standards verification. Projects lacking in these areas may face delays or fail to attract capital.

Local partnerships are essential: Working with domestic finance institutions and stakeholders not only unlocks capital, but also reduces foreign exchange risk, regulatory friction, and ensures community buy-in.

Blended & staged delivery models: Structuring projects so that early phases (planning, environmental compliance, small delivery) show traction and de-risk subsequent phases encourages funding, including from private sources.

Delivery capacity matters just as much as planning: Investors want proof that advisory isn’t just theoretical. They favor organizations who can deliver build systems that operate, sustain, and scale.

What’s Next

Expect increased regulatory attention on resilience metrics ; metrics like flood risk, energy redundancy, disaster preparedness will become central to feasibility studies and financing.

Sustainability labels and third-party verification (e.g., FAST-Infra, ESG scores, climate stress tests) will move from “nice to have” to “must have” for large deals.

Projects that integrate multiple benefits ; e.g. hydropower plus irrigation, or transport plus digital connectivity will attract more competitive investment, because they spread risk and maximize impact.

Regions with strong political stability, clear regulatory frameworks, and transparent procurement will increasingly dominate capital flows, especially in emerging markets.

Takeaway

The gap between what is needed and what is currently financed in sustainable infrastructure is not shrinking fast enough but it is narrowing. For advisory and delivery firms that can match investor expectations on risk, transparency, and delivery, 2025 represents one of the biggest opportunities in decades. Act now to ensure your projects are structured, financed, and delivered so they are investment-grade, impact-oriented, and built to last.